Lately, we have been receiving a lot of inquires from clients about how to best manage compensation in high-inflation countries, including Ghana, South Sudan, Zambia, Argentina, Venezuela, Kazakhstan, etc. (to name a few!). This post shares our guidance about managing compensation when uncontrollable events, like hyper-inflation, impact the labor market.

What are “Uncontrollable Events”?

The world is a complicated place to do business. There are many unforeseen circumstances that occur to disrupt the normal dynamics of a labor market. Examples include:

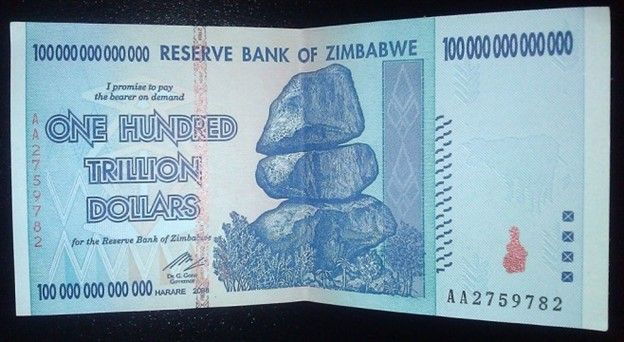

- hyper-inflation, devaluation and other economic events;

- natural disasters, such as earthquakes, floods, etc.;

- periods of unrest, civil war or other armed conflicts; and

- accidents impacting infrastructure such as the power grid and telecommunications.

I’m sure you can think of other situations that fit the definition.

You Need to Have a Policy for “Special Measures”

The common thread in all of the above uncontrollable events is uncertainty — nobody knows what’s going to happen, how long it will last, and what tomorrow may bring.

A Special Measures Policy is a way to assist managers and staff when a crisis occurs. The policy outlines what the company will do when certain uncontrollable events occur.

It might not be what employees want or ask for, but it’s what they can count on from the Company, which turns out to be even more important. Let me give you some examples using the topic everyone is asking about – high inflation.

How to Manage Compensation During Periods of Economic Turmoil

Suppose the situation you are concerned about is similar to what happened in Ghana in the summer of 2014. Devaluation over the 12 months from July 2013 in Ghana was approaching 50%. Various sources reported the annual rate of inflation in Ghana around 15% and trending higher, perhaps towards 20% by year-end. Some sources were reporting even higher numbers.

The first thing to consider is whether or not the situation qualifies as one which should be addressed by special measures. Inflation of 15% to 20% is high, but if the increase is gradual each month then it might be possible to address it through normal compensation management, perhaps with an extra pay adjustment mid-year. But if the inflation rate were higher, say 25% or more, and the increase in inflation happened all at once (or over a short period of time), then special measures might apply. Devaluation is generally not a factor in determining salaries for local staff. However, high devaluation is normally followed by periods of high inflation, so it becomes relevant.

Our recommended approach to managing a situation like the one described above is as follows:

- If the threshold you’ve set for inflation (for example) is reached or exceeded, apply your special measures. When establishing thresholds, be sure to identify multiple, reliable data sources. Be wary of official sources.

- We suggest providing an across-the-board increase of no more than 25% of the inflation (e.g., if inflation is measured at 40%, provide no more than 10%, which is 25% of 40%). Be sure to consider your desired market position and adjust the increase to be sure you don’t exceed where you want to be positioned in the market.

- Treat the increase as a temporary allowance separate from base salary.

- Monitor the market over the next three to six months through the use of market surveys, and conversations with consultants and other employers in the market.

- When the market movement, as measured by the surveys and other data, exceeds the amount of the temporary increase, it’s time to convert the temporary allowance into base salary.

- Having two increases per year instead of one often helps smooth out the disruptions, too.

Why does this approach work? There are several reasons:

- You have a policy which can relied on by your employees, providing them with some certainty in an otherwise uncertain period in their country.

- While employees often express the need to be “kept whole” that is not how it works — your policy clearly indicates that the Company will offer only partial compensation for special measures. There are no surprises, and you continue to use cost of labor, not cost of living, to drive your compensation program.

- It’s a very conservative approach, allowing you to continue to monitor the situation and increase salaries slowly, ensuring you can continue to manage your compensation according to market conditions rather than uncontrollable economic events.

- It’s unlikely that you will over-compensate for an event, thus allowing you to have positive employee communications and avoid any possible acquired-rights issues.

There could be variations on how a Special Measures policy is implemented, which types of events are covered, and the specific steps each Company decides to follow.

The important thing is to have a policy and use it.

Employees want to rely on you to help them during a crisis, and managers want to be able to make decisions quickly during difficult times. A clearly written policy for Special Measures addresses these concerns easily.

Other Resources

I have written a few other articles for my blog on related topics that you might find useful as well. Although they were written a few years ago, the information is applicable to current conditions as well.

Here are three useful links:

Warren joined Birches Group in New York as a partner in 2007, following a long career in Compensation and Benefits at Colgate-Palmolive. He held the position of Director, International Compensation for 10 years immediately prior to joining Birches Group. Warren has broad experience working across the globe with clients on local national and expatriate compensation projects. He leads our Business Development and Client Services teams and manages our strategic partnerships around the world. Warren previously held leadership positions for the Expatriate Management Committee of the National Foreign Trade Council and was president of the Latin America Compensation and Benefits Forum.