When companies need to set or review salaries, they normally use local market data as their external reference. But what do you do when there is no local market data available? This is common in smaller countries where there are not as many established employers and little to no survey providers are present. As HR consultants, we have received many inquiries on this matter and have seen companies resort to using salary data from nearby countries in the region as their proxy.

While it is understandable that in this case, companies would think that salary data closest to them in terms of proximity could be a valid alternative because perhaps countries within the same region would share similar characteristics, this is certainly not the case. We conduct salary surveys in over 150 countries, three times a year and would argue that while the country next door would have many similar jobs as your own, salary rates and pay packages are considerably different.

In Birches Group, we believe that local staff salaries should always be based on local market data. Here’s why:

The cost of labor in every country varies significantly, even if they all belong to the same region. Local conditions and availability of talent are what drive salary movement in any country. Talent that could be widely available in one market, may be very limited in another. So, when smaller markets reference their salaries against larger markets, especially if they are regional locations where wages are usually three to four times higher, those salaries would be overstated if put into the local context.

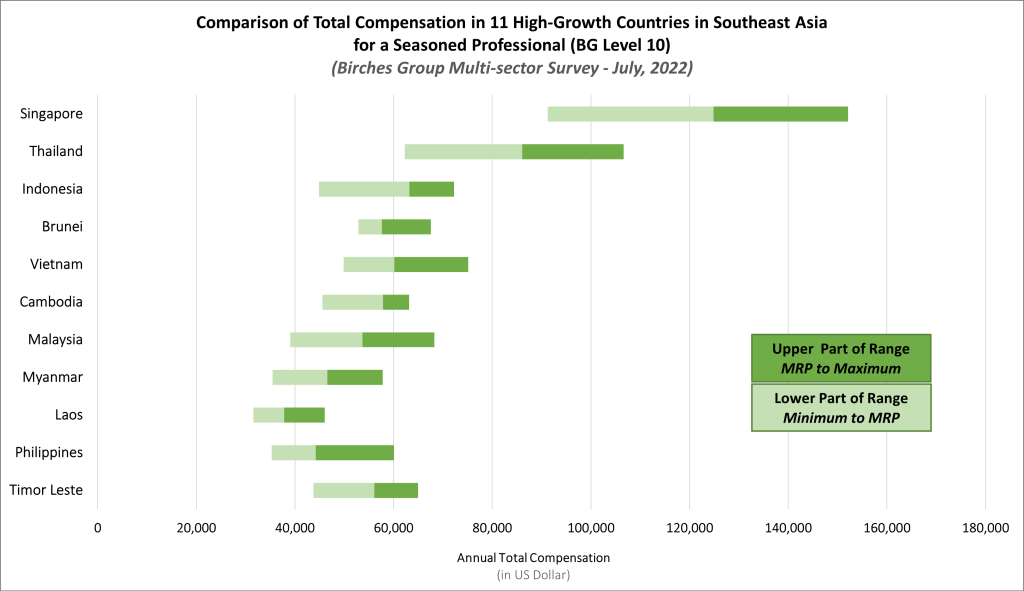

Using the example above, this is a chart that illustrates the equivalent pay range for a BG-10, a Seasoned Professional, in each of the Southeast Asian labor markets. If you are an employer in Laos and lack salary data for a BG-10 level, it would not be advisable to reference the equivalent salary range in Thailand just because you share a border with them. Similarly, if you were to apply Thailand pay ranges locally in Myanmar, not only are you significantly overpaying, but this would also be challenging to defend and maintain moving forward.

Market practice on compensation and benefits is different for every country. For some markets, certain allowances or benefits are mandated by local law, while other markets do not share the same requirement. In other countries, employers provide benefits to address local hardships, such as a company shuttle provided to staff to address the lack of public transport. But if you look at other countries in the same region, this may not be the case. Also, some countries have benefits that are cultural in nature making it unique to their market, while others could have something else. If you reference pay practices from other countries, you risk ignoring the unique conditions of your own market. See this example below:

The chart above illustrates total compensation pay packages for a BG-10 Seasoned Professional in ten countries in east and southern Africa. If you look closely, each component of total compensation varies for every country. Using the example above on pay practices, if you are an employer in Tanzania for example, the pay mix at the BG-10 level is comprised of not only cash benefits on top of base salary but in-kind benefits as well. But choosing to use salary data from Kenya because they are close and they are a regional hub, the pay mix toward total compensation is not the same. If you apply this in the local Tanzanian context, you are missing market practices on in-kind benefits compared to other employers in the local market.

So What Should You Do?

If your organization is in a small market in need of salary survey data, we recommend working with a survey provider whose methodology is designed for developing markets. Survey providers are equipped to launch local salary surveys that can bring employers the market data they need to inform their pay management policies accordingly.

Birches Group’s Community Market Compensation and Benefits Surveys are designed with developing markets in mind. And because developing markets are dynamic, our surveys cover all elements toward total compensation to give our clients the full context of the local labor market. Contact us to access the market data you need or to learn more about our subscription options.

Want to know if your existing compensation practices have the elements of a good compensation program or if there are areas that could use some improvement? Take our quick Compensation Program Assessment Quiz

Bianca manages our Marketing Team in Manila. She crafts messaging around Community™ concepts and develops promotional campaigns answering why Community™ should be each organization’s preferred solution, focusing on its simplicity and integrated approach. She has held various roles within Birches Group since 2009, starting as a Compensation Analyst and worked her way to Compensation Team Lead, and Training Program Services Manager. In addition to her current role in marketing and communications, she represents Birches Group in international HR conferences with private sector audiences.

Follow us on our LinkedIn for more content on pay management and HR solutions.